Specific Commodity Rates – SCR

Specific Commodity rates are usually lower than general cargo rates and are published for particular commodities. The list of such commodities and their 4-digit codes are reflected in the TACT Rate books.

Each country may consider a specific rate for some consignments to improve their export by offering lower rates, commercial rates. You may see the 4-digit code before the weight break and you can use it, if your cargo has the same description of that code.

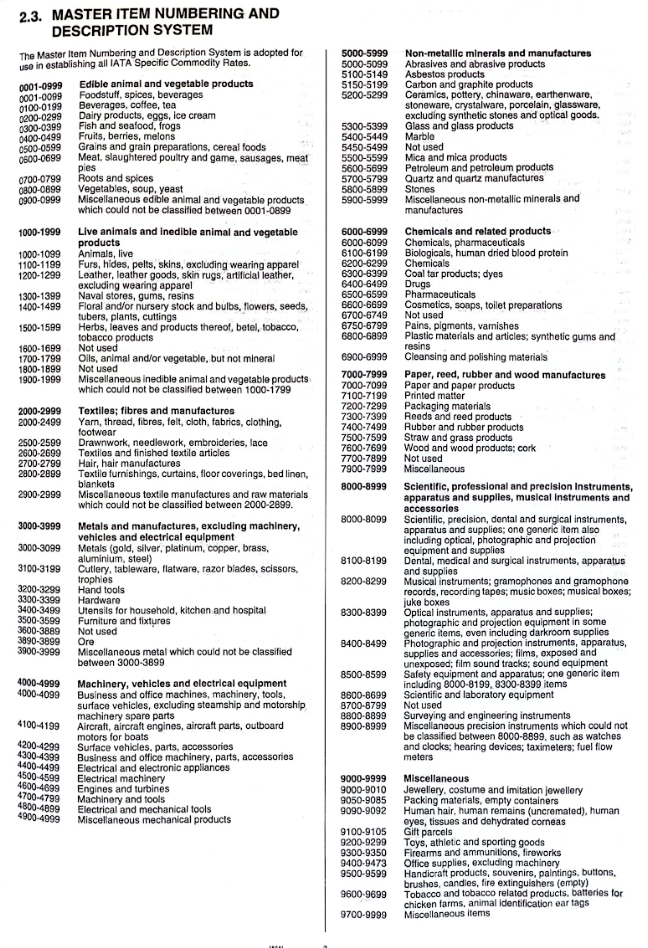

Below is the shape of Master item numbering and their description: (Shape 4.5.A)

All the cargoes that can be classified under specific commodity has been listed and defined by a code. These items divided into 10 different categories having codes of 0001 till 9999 as below:

0001-0999 – Edible animal and vegetable products

1000-1999 – Live Animal and inedible animal and vegetable products

2000-2999 – Textiles …

3000-3999 – Metals and manufacturers, …

4000 – 4999 – Machinery …

5000 – 5999 – Non-metallic minerals …

6000 – 6999 – Chemicals

7000 – 7999 – Paper, reed, rubber and wood manufacturers,

8000 – 8999 – Scientific, professional ….

9000 – 9999 – Miscellaneous

To understand how the SCR rates may apply, we go for below example:

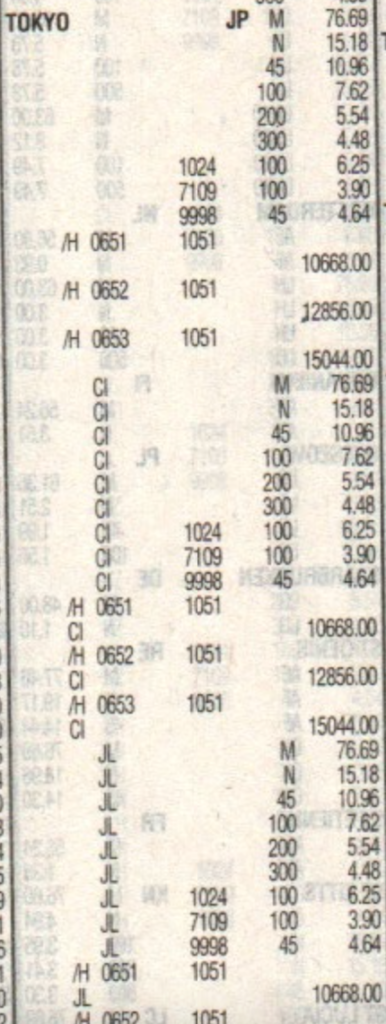

Rate from an origin to Tokyo (TYO) city reflected in below picture. (Shape 4.5.B)

Below the M, N and Quantity rates, you can see the rate of 100 kg, having a code on the left side as 1024, This is the item number of some consignments and have the rate of 6.25 as shown in the picture.

Below that is the rate for item number 7109. The rate is 3.90 for 100 KG of cargo and more than that.

For item number 9998, the rate for 45 kg cargo (and above it) is 4.64.

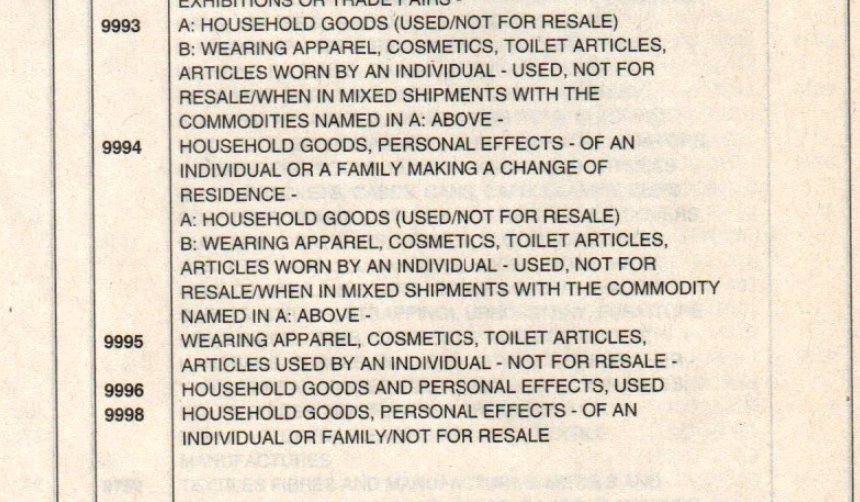

To use these rates, we have to find out what type of consignments can fall under item number 1024, 7109 or 9998. To do that, we will refer to the TACT rates book that in the beginning of the book there are some pages in pink color shows the definition of all the item numbers. A sample of that page is shown in the shape 4.5.C. Here shows item number 9998 can be used for “House hold goods and personal effects for family or individual and not for re-sale” so if a customer has such cargo, for +45 kg of the shipment, the rate to Tokyo can be used as 4.64.

Scrolling down in the picture 4.5.B, there are some rates that on the left side of them, the code “CI” is shown. It clarifies that these rates are only applicable if the carrier is “CI” airline. If we do not know what airline has the code of CI, we can find it in TACT rules book that shows CI is China Airline.

B & K rates

Between a number of countries in Europe a different rating structure is applicable.

This consist of a basic charge per shipment, regardless of its weight, plus a rate per kilogram. The basic charge is referred to as “B” while the rate per kilo is shown as “K”.

Fraction of half kilogram must be charged for as the next higher half kilogram. (More accurate explanation: Section 3 of IATA TACT RULES)

Example of it is shown at shape 4.6.

Class Rates

In the absence of Specific Commodity Rates (SCR), Class Rates are applicable for Live Animals, Valuable Cargo, Human Remains, Newspapers, Books and Baggage shipped as Cargo, subject to the rules provided in TACT Rules book, section 3. These commodities can be carried in percentage of increase or reduction in the rates. This percentage may be applicable to the GCR rates.

Newspaper, Magazine, Books and Periodicals and Baggage shipped as Cargo, containing personal effects of the passengers will normally have discount in the rates (Reduction).

Live Animal (AVI), Valuable Cargo (VAL) and Human Remains (HUM) normally have a percentage increase in the rates (Surcharge), considering the special handling involved for such carriage.

Any consignment having a declared value for carriage of USD.1,000 or more per KG is considered as valuable cargo.

The reduction or surcharge for the rates are normally being shown as a percentage N rates but in some special cases it may be considered on GCR Rates.

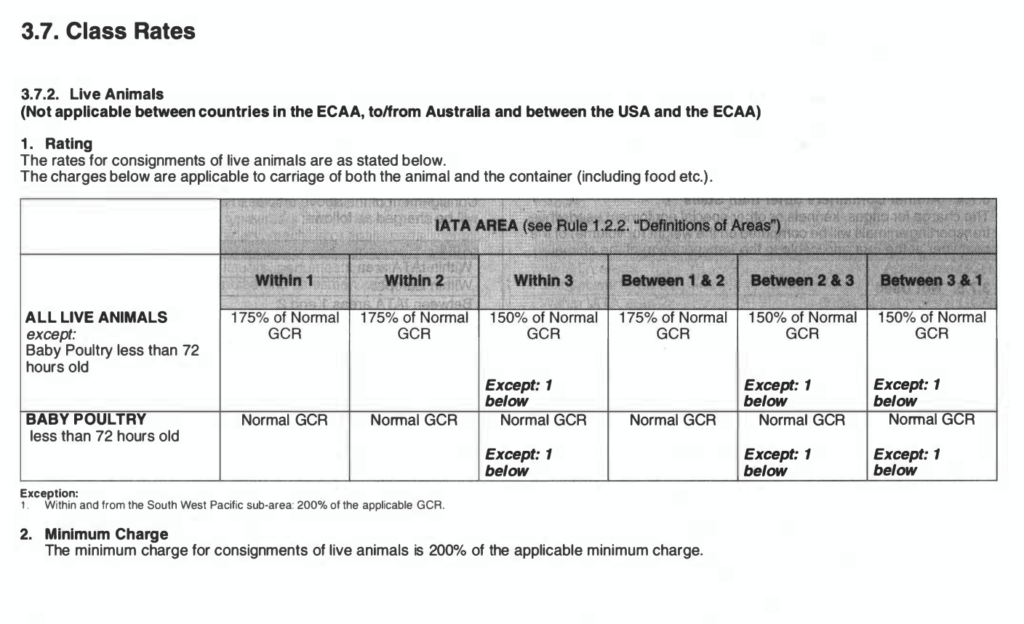

Below table (Shape 4.7.A) shows how Live Animal rates will be applicable. There are two rows that showing All live animals, except baby poultry and the other row is the rate for Baby Poultry shipments.

In different columns of the table, the percentage of increase on Normal GCR rates is shown. This percentage will be applicable to the GCR rates from an origin to a destination.

For example, if the origin of the consignment of Live animals in IATA area 1 and the destination located in IATA area 2, we have to refer to the column named “Between 1 & 2” and below that, you can see “175% of Normal GCR”.

It means that 175% of N rate is applicable, except for baby poultry. We cannot use the rate of other weight breaks for sending live animals.

For baby poultry, N rate is applicable. It means that, any weight of this shipment should only be multiplied into N rate and not other weight break rates.

Sometimes in finding the surcharge or reduction rates, we may see “150% of applicable GCR” or similar to it with different percentage. It means that if the cargo is 100 kg and the rate is available for such weight, we have to use the rate of 100 kg * 150%.

Below the table the rate for M shipments also shown and mentioned that 200% of the applicable M shall be used for carriage of such live animals for Minimum consignments.

To find out the exact charges, we always have to refer to the recent issue of TACT Rules.

In shape 4.7.B, you can see the reduction or surcharges that is applicable for other type of shipments like Valuable Cargo and Newspapers, magazines, periodicals, ….